4% INTEREST RATE

Let’s explore this offer’s details and see if it’s a good fit for you!

With a 4% interest rate, Sterling Homes Calgary Exclusive offer can help you achieve your dream of becoming a homeowner. There are advantages to this offer, but you might be wondering: Is this the right option for me?

Overview: Benefits

- Pass a lesser stress test to qualify for a bigger purchase amount. This enables candidates who couldn’t qualify with their existing bank to do so (i.e. Qualify for $100k more with the same income)

- To meet a given price point for affordability, the applicant can qualify with a lower household income (i.e. They can qualify for the same house with a $20k lower income)

- Lower payments for the first six months offer advantages for savings on up-front costs (ie. Save $4000 in first six months with lower interest rate payments)

Who would benefit from this offer?

If you fit into one of these groups, this might be the ideal time for you to realize your dream of becoming a homeowner:

- Those who can’t qualify because their income isn’t high enough

- Those who wish to receive approval for a larger sum/price

- Those looking to save money up front

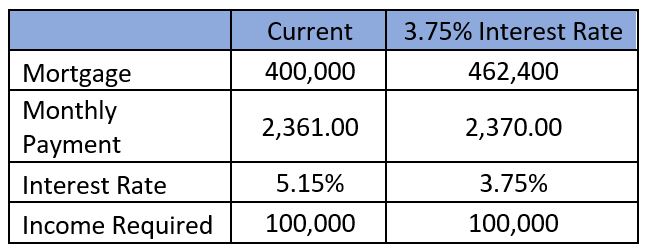

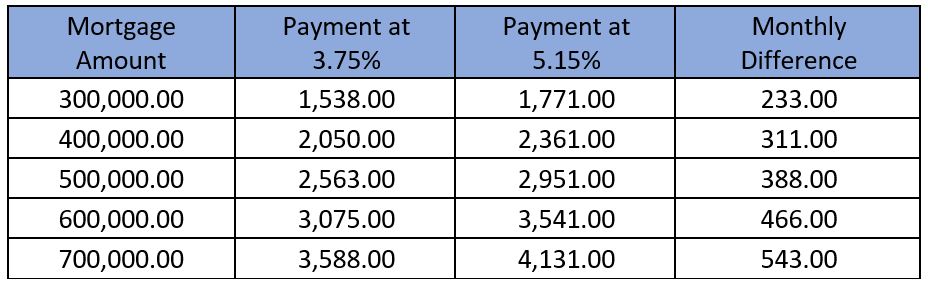

Comparing Payment Disparities & Qualifying Rates:

As mentioned above, the monthly savings as well as the payments based on a 4% mortgage rate as opposed to a 5.15% mortgage rate. As you can see, there is a sizeable monthly savings; however, it’s crucial to remember that the 4% interest rate is only for a 6-month term. Continue reading to see the fine print.

Register to be connected with our Sales Team

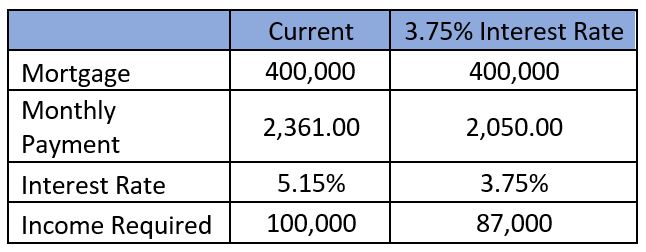

Scenario 1: You’re unable to qualify due to insufficient income.

As you can see, qualifying at 4% interest reduces both your necessary income and monthly payment.